Tezz ago and everyone, my name is Derek Ifasi. I'm the owner of Fosse Financial Group. Today's topic is the FERS annuity supplement review. Right now, if you're watching this video, you're some sort of federal employee and you might have come into contact with the word "the FERS annuity" or something known as the CSRs annuity. The first annuity stands for the Federal Employees Retirement System (FERS). It is a defined benefit plan, essentially a pension plan. Working for a federal agency provides good retirement planning options. The FERS annuity option is available depending on your employment start date. After a certain number of years of service, you become eligible for a specific dollar amount, a defined benefit of lifetime income for yourself or you and your spouse. To provide an example, my uncle, a retired IRS agent, has access to a FERS annuity. A percentage of his salary was being taken out during his working years and invested by the federal agency to create a larger retirement fund. After completing a certain number of years of service, he had access to his pension plan and could turn on his lifetime income amount. He turned on the FERS annuity supplement, which provides him with a defined benefit pension income stream. In addition, he also receives a very small amount of Social Security income. The amount of Social Security income you receive depends on your employment with the federal agency and how it is set up properly. In summary, by leveraging the FERS annuity income stream, the Social Security income stream, and the existing amount in your TSP, you could have three different income streams during retirement. The FERS annuity provides a defined benefit pension income stream, while Social Security and the TSP (Thrift Savings Plan) contribute additional income. (Note: The original text was divided...

Award-winning PDF software

Csrs lump sum death benefit calculator Form: What You Should Know

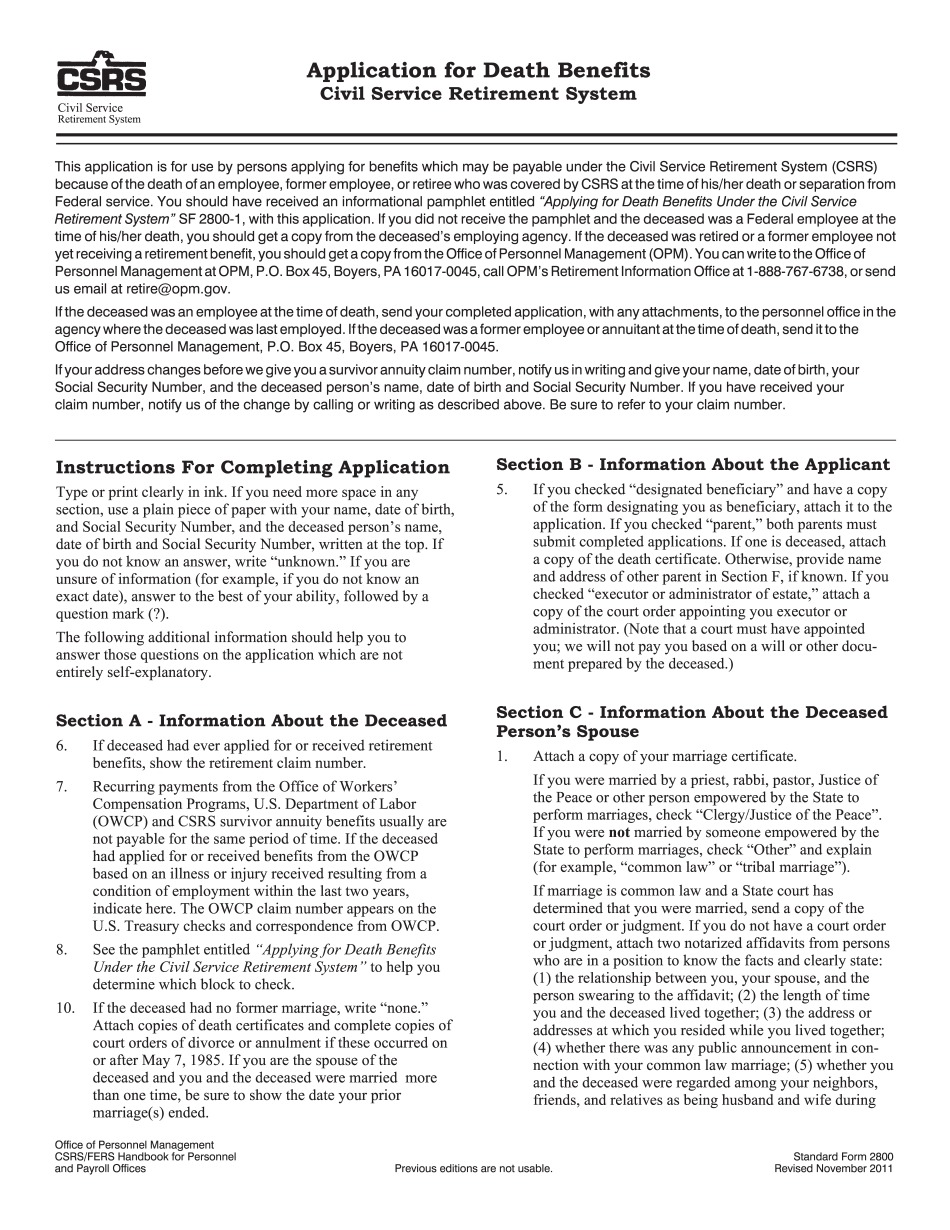

Applying for Death Benefits Under the Civil Service — OPM If you leave a dependent child who meets the qualifying age and condition, a lump-sum death benefit equivalent to the amount of the benefits payable to that child shall be paid immediately. If no dependent child is covered, the lump-sum death benefit shall be paid as soon as the dependent child attains the age of 17 and has met all the following: Is a full-time student in a private, not-for-profit elementary or secondary school; or Is attending any other educational institution with such characteristics as to be accredited What Is the Lump Sum Death Benefit and Who Is Eligible for Jun 20, 2024 — This column discusses the lump sum death benefit paid to survivors of deceased Federal Employees Retirement System (FEES) pensioners who died after September 20, 1986.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sf 2800, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sf 2800 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sf 2800 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sf 2800 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Csrs lump sum death benefit calculator