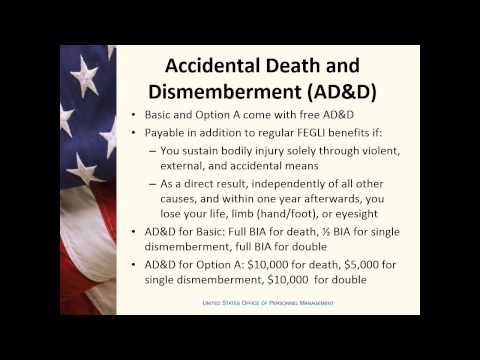

Welcome to your FEGLI life insurance for federal employees. I'm Dave Johnston with OPM. In this presentation, you will learn the basics about the federal employees group life insurance program (FEGLI). This information is current as of May 2015. Life insurance is not for everyone, but it can be a valuable resource to protect your family from unexpected financial devastation. Your death could leave your family unable to pay for housing, monthly bills, or other expenses because they won't have your income to support them. On top of that, most funerals today cost more than $7,000 and they can easily cost thousands more. Life insurance can help your family cover your final expenses and make ends meet until they can get back on their feet. In 1954, Congress established the federal employees group life insurance program (FEGLI), and over the past 60 years, it's become the world's largest group life insurance program. FEGLI covers the lives of over 4 million federal employees, annuitants, and family members. With FEGLI, you can get life insurance coverage starting at 1 year salary, up to six times your salary, and many options in between. You can even bring the coverage into retirement if you meet certain requirements. There are two categories of FEGLI coverage: basic and optional. Basic covers the life of the employee in an amount equal to your annual rate of pay rounded up to the nearest whole thousand dollars, plus $2,000. So, if you have an annual rate of pay of fifty-seven thousand one hundred dollars, enrolling in basic would cover your life for sixty thousand dollars. This is called your basic insurance amount (BIA). Eligible new employees are automatically enrolled in basic unless they waive it. The other kind of FEGLI coverage is optional coverage. You must have basic to be eligible for any type...

Award-winning PDF software

Fers beneficiary Form: What You Should Know

Forms for all employees may be retrieved directly from each agency's FEES, Federal Employees Retirement System, website. In an effort to help agencies and employees find the information they need about Designation of Beneficiary (SUB). Retirement System — FEES — U.S. Government, there are two forms for the SUB. The Forms are Form FEES — SUB — 4 — FA — U.S. Government. The Forms provide an online tool, online forms and links for all federal employees retirement system (FEES) programs. See also the sections below, if you are an annuitant, a retired Federal Employee, or any other participant in the Federal Employees Retirement System: A. Federal Employees Retirement System Forms FEES — Sub. I am an annuitant, retired Federal Employee or a participant in the federal retirement system. Who should I designate as an estate executor for my estate? FEES is a form of retirement compensation and retirement savings for federal employees and their dependents with the Federal Employees Retirement System (FEES). Federal Employees Retirement System (FEES) provides a financial retirement program for federal employees including the following: pension plans, a Thrift Savings Plan (TSP), a pension incentive plan, and an annuity. The annuity component covers a portion of the federal salary. The annuity payments are tax-preferred and are paid on a monthly basis. If you are retired (eligible for retirement) and want to make a contribution to your Federal Employees Retirement System (FEES) (either as a participant or annuitant) you must complete the Annuitant or Participant Direct Distribution (ADD) Form with appropriate documentation. If you are eligible to make a contribution to the FEES and your employment ends, you will need to use Section 1397 of the Internal Revenue Code for receiving annuity payments if your employment ends with the Federal Government; otherwise, you can use section 713 of the Internal Revenue Code to make an annuity contribution and pay a 10 percent early withdrawal penalty or Section 72(t) of the Internal Revenue Code for receiving a TSP withdrawal. There is also a benefit option from the FEES for self-employed individuals called the “Employees Retirement Benefits Plan” (ERS BP), which is similar to FER SP but is not an annuity plan or qualified plan. The self-employed need not make a contribution to this benefit option.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sf 2800, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sf 2800 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sf 2800 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sf 2800 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fers beneficiary form