TSP withdrawal options have been updated for 2019. I receive a lot of questions and inquiries from people seeking information on various TSP withdrawal options under the new TSP Modernization Act of 2017. Although I have addressed this topic in previous videos, I continue to receive numerous emails asking for clarification. Recently, a lady shared an article with me on this matter, which I have discussed before. However, I believe it is important to go over it again as it holds significant value. Given the substantial amount of money involved in TSP, it is crucial for individuals to be well-informed and make wise decisions to avoid potential financial loss. In addition to discussing TSP withdrawal options, we will also cover TSP taxes in a separate video. If you find this content useful, please subscribe to the Heritage Wealth Planning YouTube channel, like, comment, and share this video with others who are part of the TSP (Thrift Savings Plan) community. Now, let's move on to the article. A friend of mine sent me an article from the National Association of Retired Federal Employees (NA RFP), although I am unsure of the date it was published. Regardless, it is a valuable piece of reading material, and I have shared it with you all before. We will review it again because the information is incredibly important. The article discusses various TSP withdrawal options and the strategies retiring employees should consider to meet their specific needs. Let's go straight to the section that outlines the primary choices. There are several primary choices for utilizing TSP funds in retirement, and while there are variations, they include: 1. Leaving the money in the TSP until the age of 70.5 when required minimum distributions (RMDs) are mandatory. 2. Taking a partial one-time withdrawal. 3. Taking a full withdrawal as a...

Award-winning PDF software

Fers lump sum payment Form: What You Should Know

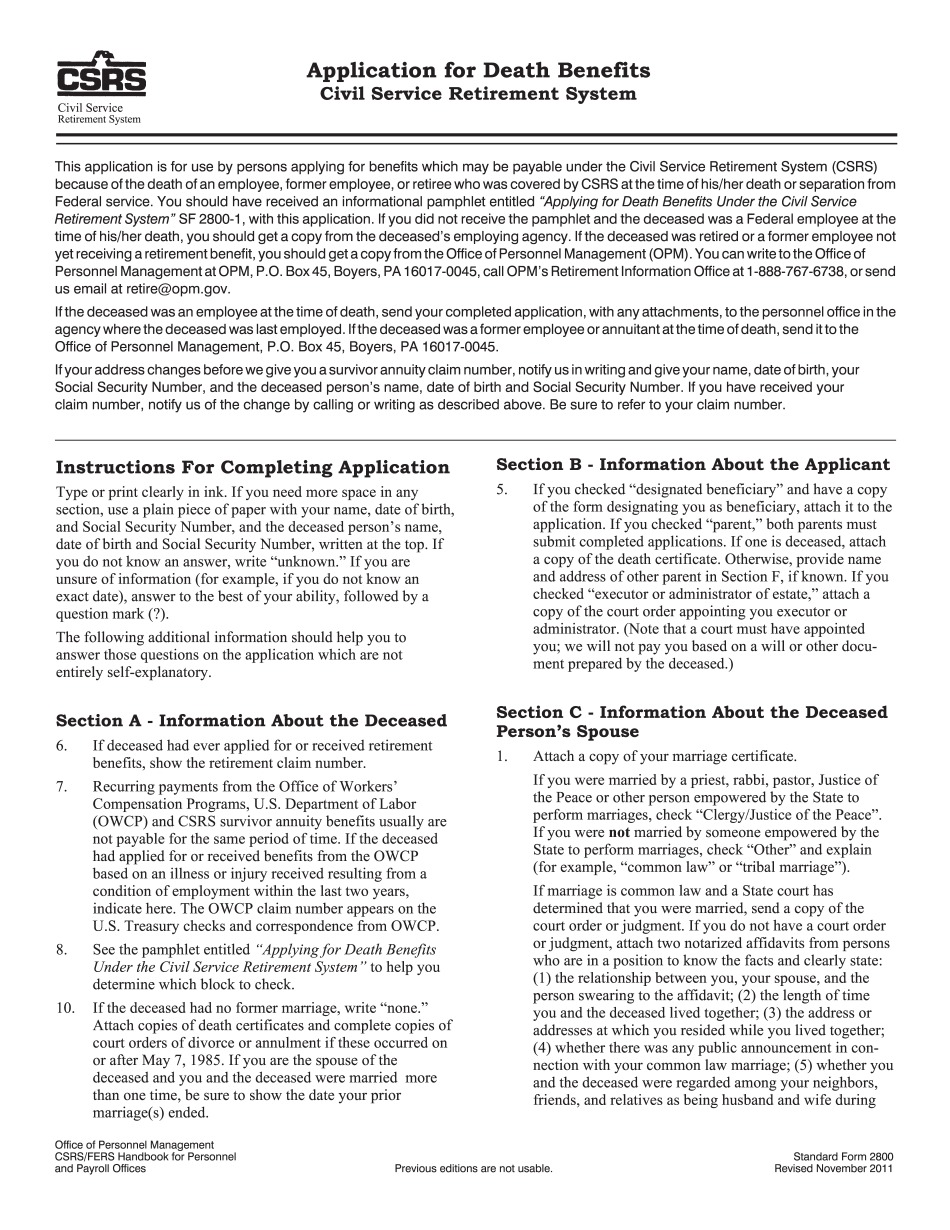

Please submit the completed form to the address below: Attn: Benefits Processing, P.O. Box 30098, Washington, DC 21105, or FAX: The following is the description of the forms found in the federal government's online file : Form 2803. Application for Deposit or Redeposit. Application for deposit under the Civil Service Retirement System. A certified copy of this form must accompany an application for a deposit under the Civil Service Retirement System, 28 CFR part 901 (relating to the deposit of lump-sum payments of benefits of retirement under the civil service retirement plan).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Sf 2800, steer clear of blunders along with furnish it in a timely manner:

How to complete any Sf 2800 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Sf 2800 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Sf 2800 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fers lump sum payment